2015 highlights

Large-scale retrofit and upgrade were completed at all Rosneft refineries in 2015 driving the Company’s transition to the production of Euro-5 Class gasoline and diesel fuels for the Russian market. The Technical Regulation for the Customs Union initially set the period of transition to Euro-5 Class gasoline and diesel fuels in the domestic market after January 1, 2016. Therefore, the Company’s commitments to start producing gasoline and diesel fuel of higher environmental classes were fulfilled ahead of schedule.

Petroleum products and petrochemicals sales in 2015 grew 1 % YOY to 97.4 mmt. The sales growth is mainly driven by the sale of reserves accumulated in 2014 and additional efficient trading operations to offset somewhat decreased production.

As part of import substitution, the Company started production and successful operation of its own reformer catalyzators and hydrogen units. Only nationally manufactured catalyzators are used at all catalytic cracking units.

The Company signed a series of important oil supply contracts in the reporting year.

Rosneft and China National Chemical Corporation (ChemChina) signed a long-term ESPO oil supply contract in 2015 for up to 2.4 mmt of oil per year until July 2016.

The long-term contract for oil supply to Poland was extended for three years (from February 1, 2016 through January 31, 2019) with its conditions stipulating an increase in oil supply to 25.2 mmt.

Despite worsening macroeconomic conditions, the Company increased its high margin supplies to the East (+18.5 %), increased gas sales (3.8 %) and sale of petroleum products and petrochemicals. Therefore, the Company managed to limit the negative effect from oil price reduction by 16.3 % in RUB and 47.3 % in USD in 2015. .

The Company fully performs its oil supply obligations under long-term contracts. It also exceeds all of its petroleum product supply obligations in the domestic market and increased Euro-4/5 motor fuel supplies in the Russian Federation by 30 % YOY.

Company’s oil refining capacities in 2015

| Refinery | Design capacity at the end of the year |

Refining volume, mmt |

Yield of light oils |

|---|---|---|---|

| Tuapse | 12.0 | 9.6 | 51.2 % |

| Achinsk | 7.5 | 6.3 | 55.5 % |

| Angarsk Petrochemicals Company | 10.2 | 9.1 | 63.4 % |

| Komsomolsk | 8.0 | 7.0 | 58.2 % |

| Ryazan | 18.8 | 16.2 | 54.5 % |

| Saratov | 7.0 | 6.1 | 44.9 % |

| Slavneft-Yanos* | 7.5 | 7.6 | 55.5 % |

| Samara Refinery Group: | 24.1 | 20.9 | 56.0 % |

| Novokuibyshev | 8.8 | 8.3 | 55.4 % |

| Kuibyshev | 6.8 | 6.2 | 54.9 % |

| Syzran | 8.5 | 6.4 | 57.9 % |

| Mini-refineries | 5.4 | 1.9 | - |

| LINIK | 8.0 | - | - |

| ROG JV Refineries* | 13.4 | 10.8 | 79.2 % |

| Mozyrs Refinery* | - | 1.4 | - |

* Of Rosneft share.

Structure of petroleum product output, mmt

| Refinery | Naphtha | Gasoline | Kerosene | Diesel fuel |

Fuel oil | Other |

|---|---|---|---|---|---|---|

| Tuapse | 1.8 | - | - | 3.1 | 4.3 | 0.3 |

| Achinsk | 0.2 | 1.0 | 0.2 | 2.1 | 2.0 | 0.6 |

| Angarsk Petrochemicals Company | 0.2 | 1.3 | 0.5 | 3.0 | 2.1 | 0.8 |

| Komsomolsk | 0.9 | 0.4 | 0.3 | 2.5 | 2.6 | 0.2 |

| Ryazan | 0.5 | 2.9 | 1.1 | 4.0 | 4.9 | 2.2 |

| Saratov | - | 1.0 | - | 1.7 | 1.6 | 1.5 |

| Slavneft-Yanos* | 0.2 | 1.3 | 0.6 | 2.0 | 2.5 | 0.5 |

| Samara Refinery Group: | 0.7 | 3.3 | 0.4 | 7.0 | 6.5 | 1.5 |

| Novokuibyshev | 0.3 | 1.3 | 0.4 | 2.6 | 2.2 | 0.8 |

| Kuibyshev | 0.2 | 0.9 | - | 2.1 | 2.3 | 0.2 |

| Syzran | 0.2 | 1.1 | - | 2.3 | 2.0 | 0.5 |

| Others (mini-refinery incl.) | 1.2 | 1.9 | - | 0.9 | 0.1 | 2.4 |

| ROG JV* | 0.5 | 2.0 | 0.7 | 4.8 | 0.4 | 2.8 |

OIL REFINING

LIGHT PRODUCTS YIELD FROM THE COMPANY’S REFINERIES IN RUSSIA IN 2015

convertion rate IN RUSSIA IN 2015

The Company has the largest oil refining capacities in Russia. The volumes processed at its refineries in the Russian Federation amounted to 84.7 mmt in 2015, being the best level for the Company in the current demand conditions and oil/petroleum product price environment. However, the yield of light petroleum products grew from 54.8 % in 2014 to

55.3 % in 2015, and convertion rate from 65.3 % in 2014 to 66.5 % in 2015 driven by higher vacuum gasol production and optimization of secondary processes.

A reduction in total oil refining volumes (including Company’s international refineries) to 96.9 mmt (-3 %) in 2015 YOY was mainly due to redistributed volumes to YOY more high-margin sales channels subject to the adverse impact of the tax maneuver on the refining segment profitability and worsening macro environment as well as due to the suspension of refining at Mozyrsky Refinery under a processing contract in Q1 2015 and related oil redistribution to more profitable sales channels.

In 2015, Russian refineries increased the production of Euro-4/5 Class motor fuels that meet the requirements of the Technical Regulations of the Customs Union. The share of Euro 4/5 Class gasoline and diesel fuel in 2015 was 95 % and 73 %, respectively YOY (vs 73 % and 54 %, respectively).

Key achievements in refining for 2015

domestic refinery throughput

total refinery throughput (INCLUDING FOREIGN REFINERIES)

The Company’s refining efforts in 2015 were aimed at satisfying market demand for high-quality petroleum products by continuing implementation of the refinery upgrade program and transition to producing Euro-5 environmental class fuel. Priorities also included import substitution and development of in-house technical infrastructure.

1. Implementation of the upgrade program for Russian refineries

The refinery upgrade program is in progress in the Russian Federation. It involves the construction and renovation of process plants increase convertion rate and light product yields, and improve motor fuel quality to supply the Company’s sales channels with the petroleum products that meet the requirements of the Technical Regulations for the Customs Union.

Under the Modernization Program:

- isomerization units were started up at Kuibyshev and Novokuibyshev Refineries and at Ryazan Oil Refining Company;

- catalytic reformers were rebuilt at Syzran and Kuibyshev Refineries;

- the MTBE unit was fully built at Angarskaya Petrochemicals Company.

2. Conversion to Euro-5 motor fuels

Large-scale retrofit and upgrade were completed in December 2015 at all Rosneft refineries in 2015 driving the Company’s full transition to the production of Euro-5 Class gasoline and diesel fuels for the Russian market.

3. Import substitution, development, and launch of new products

- As part of import substitution, the Company started production and successful implementation of own catalizators for reformers and hydrogen units.

- Only nationally manufactured catalyzators are used at all Company catalytic cracking units.

- A composition was developed for a lubricity additive to RT and TS fuel to substitute imported HiTEC-580 additive. It passed all proper tests with satisfactory results.

- The Company started to use at its refineries upgraded PPD VES-410d produced by Angarsk Catalyzer and Organic Synthesis Plant.

Novokuibyshevsk Refinery

Throughout 2015, the plant refined 8.3 mmt of crude oil, produced 2.3 mmt more Euro-4/5 fuels YOY. Convertion rate amounted to 70.9%.

The essential investment in 2015 was allocated to support the existing capacity, build a hydrocracking and hydro-treating facilities, and engineering under other refinery upgrade investment projects.

Novokuibyshevsk Oil and Additive Plant

In 2015, the plant continued its Program for development of high-quality oils production under hydroprocessing facility construction projects (stages I and II) as well as environmental and infrastructure projects.

Program implementation will allow achievement of a sustainable development level and improve oil business profitability of Rosneft and competitiveness of plant products.

Kuibyshev Refinery

Refined crude oil in 2015 amounted to 6.2 mmt and convertion rate reached 61.0 %. Euro-4/5 fuel production in 2015 was 2.3 mmt more than in 2014.

Major investment in 2015 was allocated for the construction of a catalytic cracking unit with auxiliary facilities and MBTE unit. The company continued to invest in the construction of a vacuum gasoil hydro-treatment unit, hydrogen and sulfur units, and maintenance of the existing capacities.

Syzran Refinery

Oil refining amounted to 6.4 mmt in 2015 with convertion rate of 67.6 %, which was 1.6 % more YOY. Euro-4/5 environmental class fuel production was 1.2 mmt more than in 2014.

Major investment in 2015 was allocated to finance the large-scale plant upgrade, including construction of catalytic cracking facilities, MBTE unit, and diesel fuel hydro-treatment capacities, as well as to maintain the existing capacities.

The upgrade of Reformer ЛЧ-35 / 11-6000 was fully completed and aligned with the industrial safety requirements in November 2015.

Ryazan Refinery

A total of 16.2 mmt was refined. The convertion rate amounted to 68.6 %, being 3.3 % above 2014.

Major investment in 2015 was allocated to maintain the existing capacities and continue the implementation of the comprehensive plant development program.

A low-temperature isomerization unit, RCPSA, and VT-4 vacuum unit were started up in 2015 and the first rebuild stage was completed at the diesel fuel hydro-treating facilities.

Saratov Refinery

The plant refined 6.1 mmt during 2015 with a convertion rate of 72.0 %.

A program of long-term refinery development was elaborated and capacity maintenance projects were implemented in 2015.

Tuapse Refinery

Throughout 2015, the plant refined 9.6 mmt, which was 1.0 mmt more than in the previous year.

Investment in 2015 was allocated to implement large-scale refinery rebuilding projects, including the construction of hydrocracking/hydro-treating and reformer/isomerization facilities with related refinery infrastructure.

ELOU-AVT-12 vacuum unit was started up in 2015 supporting the production and sale of vacuum gas oil and some refinery facilities were commissioned.

Achinsk Refinery

Refined crude oil in 2015 amounted to 6.3 mmt and convertion rate reached 66.1 %.

All motor fuels from 2015 and thereafter are manufactured in accordance with the requirements of the Technical Regulations for the Customs Union. Euro-4 and Euro-5 motor fuel output in 2015 was 0.8 mmt above the 2014 figure.

Major investment in 2015 was allocated to implement the large-scale refinery upgrade, including the construction of hydrocracking and hydrofining facilities, maintenance of the existing capacities and revamp of LK-6Us plant.

Angarskaya Petrochemicals Company

The company refined 9.1 mmt of oil throughout 2015 with a convertion rate reaching 73.8 %, which was 1.4 % above the 2014 indicator. An increase in Euro-4/5 environmental class fuels versus 2014 amounted to 0.9 mmt, including a 0.7 million ton increase in Euro-4/5 gasoline output.

The MBTE plant was fully built in December 2015 to facilitate further growth of environmentally clean fuels in 2016.

Major investment in 2015 was allocated to implement the large-scale plant upgrade, including construction of catalytic cracking gasoline hydrofining units, sulfuric acid alkylation and diesel fuel hydro-treating facilities and related infrastructure, as well as to maintain the existing capacities.

Komsomolsky Refinery

Refined crude oil in 2015 amounted to 7.0 mmt and convertion rate reached 62.8 %, being 2 p.p. versus 2014. Euro-4 and Euro-5 motor fuel output was 0.2 mmt above the 2014 level.

Major investment in 2015 was allocated to implement the large-scale refinery upgrade, including the construction of hydrocracking and hydro-treating facilities, and maintenance of the existing capacities.

Metalwork and equipment hydrocracking and hydrotreating facilities, sulfur and hydrogen units were installed in 2015 and general refinery infrastructure was built.

The ESPO-Komsomolsk Refinery pipeline branch construction was started, including all necessary infrastructure. It will be built by Transneft company.

Eastern Petrochemical Company

All efforts under EPC project and its financing in 2015 were in line with the project scheduled approved by the Rosneft’s Board of Directors.

The Government of the Russian Federation issued Decree No. 2602-r of December 17, 2015 to approve government support measures (Roadmap) to assist with the strategic investment project of Eastern Petrochemical complex construction.

Currently, surveys are in progress under the EPC project to be completed by end of 2016.

Mini-refineries

The Company holds shares in several mini-refineries in the Russian Federation with a refining volume in 2015 totaling 1.9 mmt. The largest mini-refinery is Nizhnevartovsk Oil Refining Association with a refining scope amounting to 1.5 mmt.

KEY ACHIEVEMENTS IN PETROCHEMISTRY, GAS PROCESSING AND CATALYST MANUFACTURING IN 2015

of feedstock refined at Angarsk Polymer Plant (APP) AND 441 THOUS. TONS OF HIGHLY MARGINAL PETROCHEMICALS produced

throughput of novokuibyshevsk petrochemical company, 0.85 m tons — products output

Petrochemistry

The Company produces petrochemical products at JSC Angarsk Polymer Plant (APP) and JSC Novokuibyshevsk Petrochemical Company (NPC) in Russia.

Angarsk Polymer Plant

In 2015, the Angarsk Polymer Plant processed 660 thousand tons of feedstock and produced 441 thousand tons of high margin petrochemical products (products with high added value). The main products are high-density polyethylene, propylene, and butylene-butadiene fraction.

In 2015, the Company took measures to increase the output and production efficiency, and to enhance safety and reliability of production facilities operation.

Novokuibyshevsk Petrochemical Company

In March 13, 2015 Rosneft completed the process of the acquisition of SANORS petrochemical holding. During the year, the new assets were integrated into the Company structure.

Since the takeover on March 2015 and through the end of the year, the processing capacity at Novokuibyshevsk Petrochemical Company was 0.97 mmt, and the output totaled to 0.85 mmt. The NPC produces a wide range of petrochemical products. The key petrochemical products are tert-amyl methyl ether, technical synthetic phenol, technical synthetic ethyl alcohol, acetone, liquefied petroleum gas for domestic consumption and other LPG, phenolic resin, para-tertiary butylphenol, etc.

In 2015, the Company took a number of measures to improve operational efficiency of the refinery, including technical re-equipment, optimization of natural gas supply, arranging for para-tertiary butylphenol separation scheme, as well as to maintain the production capacity.

Gas processing

The total processing capacity of Neftegorsk and Otradnensky Gas Processing Plants in the Samara Oblast is 1.8 bcm per year.

In 2015, the Neftegorsk GPP and Otradnensky GPP processed 410 and 257 mcm of APG respectively. At present, the Company is implementing a comprehensive upgrade program at its gas processing facilities. The scope of the program includes revamp and replacement of worn-out equipment with contemporary packaged units that will allow an improvement in operating efficiency and increase the level of automation.

Zaykinsky Gas Processing Enterprise, a part of Orenburgneft subsidiary, comprises Pokrovskaya Gas Treatment Unit and Zaykinskoye Gas Processing Plant, with the total annual processing capacity of 2.6 bcm.

In 2015, Zaykinsky Gas Processing Enterprise processed 2.44 bcm of associated gas (including 313 mcm at Pokrovskaya Gas Treatment Unit, and 2.13 bcm at Zaykinskoye Gas Processing Plant).

Catalyst manufacturing

THE COMPANY LAUNCHED CATALYSTS AND ADDITIVES PRODUCTION of similar quality TO FOREIGN ANALOGS WITHIN THE IMPORT SUBSTITUTION PROGRAM

THE COMPANY LAUNCHED CATALYSTS AND ADDITIVES PRODUCTION of similar quality TO FOREIGN ANALOGS WITHIN THE IMPORT SUBSTITUTION PROGRAM

As part of the import substitution program, the reformers at Syzran and Ryazan Refineries in 2015 were loaded with the local reforming catalysts manufactured at Angarsk Catalyst and Organic Synthesis Plant. The catalyst for hydrogen production manufactured at Angarsk Catalyst and Organic Synthesis Plant and loaded to the Syzran Refinery in 2015, showed good results at the same level as its foreign analogues. The new pour point depressant additive VES-410D (to improve the low-temperature properties of diesel fuels) produced at Angarsk Catalyst and Organic Synthesis Plant was delivered ti Syzran Refinery and proved its high efficiency.

The construction project of the out of pile catalysts regeneration section is underway at Novokuibyshevsk Catalysts Plant. The launch is planned for 2016. The purpose of this section is regeneration of catalysts for Euro-5 fuel production domestically in Russia (not to bring the catalysts abroad for regeneration).

A brief overview of international oil refining projects

Ruhr Oel GmbH (ROG)

TOTAL OIL SUPPLIES OF ROSNEFT AND ROSNEFT TRADING S.A. TO GERMANY FOR REFINING, INCLUDING FOR OTHER Ruhr Oel GmbH SHAREHOLDERS, IN 2015 MAKING ALMOST ONE FOURTH OF CRUDE OIL IMPORT TO THE COUNTRY

Rosneft has a 50 % stake in Ruhr Oel GmbH (ROG) JV in Germany. Ruhr Oel GmbH owns stakes in four refineries in Germany (Gelsenkirchen – 100 %; Bayernoil – 25 %; MiRO - 24 %, and PCK Schwedt – 37.5 %.), and in five supply pipelines and sea terminals in the North Sea, Baltic Sea, Mediterranean Sea and the Adriatic Sea. ROG is a leader at the German market in terms of refining throughput (21.3 mmt in 2015, including Rosneft share of 10.8 mmt). The conversion rate is above 95 %. In addition, ROG is a leader in sales of motor fuels and petrochemical products.

In 2015, the bulk volume of crude oil supplied by Rosneft and Rosneft Trading S.A. to Germany for processing, including other ROG refineries shareholders, was 21 mmt that is almost 25 % of the total crude imported to Germany.

In November 2015, Rosneft completed the purchase transaction with Total for 16.67 % share in PCK Raffinerie GmbH - PCK Schwedt Refinery located in Schwedt on the Oder in Germany. Its capacity for the crude primary processing is 11.5 mmt per year, the Nelson complexity index is 9.2. PCK Raffinerie GmbH holds a 45 % stake in the German section of the Druzhba pipeline and a share in the marine terminal for crude oil in Rostock, and owns the Rostock-Schwedt pipeline and the pipeline to a distribution terminal in Seefeld near Berlin, also owned by PCK Raffinerie GmbH. As the result of the sale contract, the total share of Rosneft in PCK Schwedt increased from 18.75 % up to 35.42 %.

In December 2015, Rosneft and BP signed a legally binding Agreement on dissolution of ROG as part of the previously initiated restructuring procedure of the oil refining and petrochemical joint venture in Germany. When the restructuring procedure is completed which is expected before the end of 2016, Rosneft will become the direct shareholder and will increase its shares respectively: in Bayernoil Refinery – up to 25 % (now 12.5 %); MiRO Refinery – 24 % (now 12 %); PCK Schwedt Refinery – up to 54.17 % (now 35.42 %). Rosneft will also increase its stake in the Transalpine pipeline (TAL) from 5.5 % to 11 %. BP, in turn, will take 100 % of the Gelsenkirchen Refinery and of DHC Solvent Chemie, the solvents production enterprise.

Both contracts will allow Rosneft to continue implementing its strategy for oil refining in Europe and to move to a new level. The contracts are aimed at maximizing the added value for the shareholders of Rosneft.

Mozyr Refinery

The Company processes its crude oil at the Mozyr Refinery in Belarus under a processing agreement. The Company has a 21 % stake in the Mozyr Refinery through Slavneft. In 2015,

the volume of Rosneft crude feedstock processed at the Mozyr Refinery amounted to 1.4 mmt,

at a conversion rate of 73.5 %.

Saras S. p. A.

Rosneft has been a minority shareholder in Saras S.p.A. since 2013. In October 2015, as part of its assets optimization and effective share management Rosneft reduced its share in Saras S. p. A.

from 20.99 % of the issued share capital of Saras S. p. A. down to 12 %. The Company will retain its representation on the Board of Directors of Saras S.p.A. The Company sold its shares to institutional investors at a price over 38 % higher than the original purchase price.

The major asset of Saras S. p. A. is the Sarroch Refinery in Sardinia. It is one of the largest refineries in the Mediterranean region with a throughput capacity of up to 15 mmt per year. The Sarroch Refinery is integrated with a 575 MW IGCC power plant.

Crude oil sales in 2015–2014, mmt

| Region | 2014 Volume, mmt |

2015 Volume, mmt |

|---|---|---|

| Europe and other destinations | 61.1 | 60.4 |

| Asia | 33.5 | 39.7 |

| CIS countries | 7.8 | 9.0 |

| Domestic market | 8.8 | 5.4 |

| TOTAL | 111.2 | 114.5 |

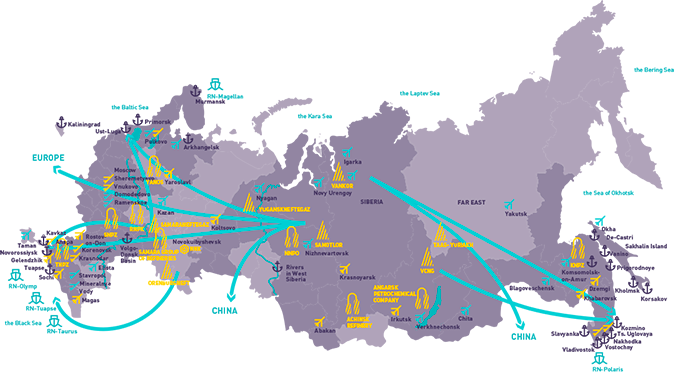

key assets IN RUSSIA and product flows

IMPROVING SALES EFFICIENCY OF OIL, GAS, PETROLEUM PRODUCTS AND PETROCHEMICALS

Crude oil sales

The Company is constantly monitoring economic effectiveness of its crude monetization channels that enables it to maximally increase the share of high margin channels in the general sales structure. In 2015, the share of high margin channels increased to 51 % of the total volume of crude (40.2 % in 2014).

In the reporting year, Rosneft supplied 84.4 mmt of crude oil to the refineries in Russia, 3 % less compared to 2014 (86.6 mmt); the reduction in supplies mainly related to redirecting the equity crude to higher margin channels due to negative impact of the tax maneuver on the profitability of the refining segment.

ROSNEFT HAS BEEN IMPLEMENTING A POLICY AIMED AT ENSURING A REQUIRED BALANCE OF CRUDE MONETIZATION CHANNELS, INCLUDING CRUDE OIL PROCESSING AT ITS OWN REFINING FACILITIES IN RUSSIA AND GERMANY, EXPORT UNDER LONG-TERM CONTRACTS AND TENDER-BASED SPOT CONTRACTS, AND DOMESTIC SALES.

In addition to crude oil supplies to its own refineries in Russia, in 2015 the Company supplied 3.7 mmt of crude to Ruhr Oel GmbH refineries in Germany, a 12 % increase compared to 2014.

In 2015, Rosneft continued supplying crude oil to the Mozyr Refinery under the processing scheme; however, the total supplies were 1.4 mmt only that is half as much than in 2014. The decrease in processing was due to decrease in refining margins and, consequently, lower efficiency of the scheme in general. The petroleum products manufactured at the Mozyr Refinery were sold domestically through the Company’s retail network and exported to the markets of Belarus and Ukraine and far abroad.

Total supplies to third parties in 2015 amounted to 114.5 mmt, including 5.4 mmt of crude oil sold domestically. Crude oil exports totaled 109.1 mmt. Supplies to the East appear to be the most lucrative export channel for the Company with pipeline deliveries to China, sales in Kozmino and De-Castri ports. The high margin supplies to the East in 2015 amounted to 39.7 mmt (including 26.6 mmt of pipeline delivery and shipping to China under the long-term agreements, and the rest volumes — via Kozmino and De-Castri ports), a 18.5 % increase YOY. The Company exported

60.4 mmt of crude oil to the North-Western, Central and Eastern Europe, the Mediterranean countries and other far abroad countries. The export to the CIS countries totaled 9.0 mmt.

The major part of the Company export volumes is supplied via Transneft facilities, including the trunk pipeline network and the ports. In the reporting year, the preferred routes of crude oil supply were as follows:

- pipeline transport – around 100.3 mmt, or 91.9 % of the total crude oil exports. Over 42 mmt of this volume were exported via seaports (including 14.9 mmt via Primorsk; 6 mmt via Novorossiysk; 8.6 mmt via Ust-Luga; 12.9 mmt via Kozmino, including 3.6 mmt to China under the long-term contract), and other 58 mmt via pipeline to China (23.0 mmt), Belarus (8.3 mmt), the Central and Eastern Europe (26.2 mmt);

- railway and mixed transport – 5.3 mmt, or 4.9 % of the total export. These were mainly supplies via the Caspian Pipeline Consortium (CPC) (4.6 mmt) and via railroad to Belarus

(0.7 mmt).

Apart from the abovementioned destinations, in 2015, 3.5 mmt of crude oil were shipped via De-Castri export terminal, a twice increase compared to 2014. Such an increase was driven by the production increase in Severnoye Chaivo field. De-Castri export terminal with a capacity of 12 mmt per year is owned by Sakhalin-1 project consortium, where Rosneft holds a 20 % stake.

In 2015 supply volume via Kozmino to China under the lont-term contracts amounted to 3.6 mmt (largely owing to redestribution of supply volumes from “Skovorodino-Mohe” route).

In 2015, the Company supplied 4.6 mmt of crude oil and gas condensate via Caspian Pipeline Consortium (CPC) including Russia’s quota managed by Transneft. The CPC pipeline runs from the Tengiz oil field in the Western Kazakhstan to the Novorossiysk Port. Rosneft has been participating in the CPC project since 1996 through Rosneft-Shell Caspian Ventures Ltd. (7.5 % stake in the project). The Company holds 51 % of the venture, with Shell holding the remaining 49 %.

Crude oil supplies under long-term agreements

In 2015, the Company continued supplying Urals crude oil to Glencore, Vitol and Trafigura via Novorossiysk, Primorsk and Ust-Luga ports under contracts, payable in advance. These contracts provide a sustainable long-term channel for crude oil supply, with selling prices under contracts corresponding to those obtained by the Company in regular tenders.

In 2015, 14.68 mmt of crude oil were supplied under these contracts, including:

- Glencore — 8.34 mmt;

- Vitol — 4.60 mmt;

- Trafigura — 1.74 mmt.

In 2015, the Company continued supplying crude oil to China National Petroleum Corporation (CNPC) under long-term contracts. The scope of supplies to CNPC in 2015 totaled 26.6 mmt, including 7 mmt of crude oil supply in transit through Kazakhstan.

In 2015, the Company continued supplies to BP Oil International Limited under the long-term contract providing for export deliveries of petroleum products with possible substitution with crude oil within 5 years. In 2015, 1.3 mmt of fuel oil and 0.6 mmt of crude oil were supplied under the contract.

Extending cooperation in crude oil and petroleum products trading

In June 2015, at the St. Petersburg International Economic Forum Rosneft and China National Chemical Corporation (ChemChina) signed a supply contract under which ESPO oil blend shall be supplied directly to the Chinese company, with the volume up to 2.4 mmt per year for the period until July 2016.

During the BRICS summit in Ufa in July 2015, Rosneft and ESSAR, an Indian company, signed a long-term contract for crude oil supplies to the ESSAR Refinery at Vadinar (India). The contract was signed based on arrangements agreed by Vladimir Putin, the President of Russia, during his official visit to India in 2014, providing for supply of 100 mmt of crude oil within a 10-year period.

Petroleum products sales

In 2015, the Company significantly increased the volume of its petroleum products export to

61.5 mmt (2014: 57.6 mmt).

In 2015, the Company started to sell fuel oil (VGO) produced at Komsomolsk, Angarsk and Tuapse Refineries. This allowed expanding the range of petroleum products supplied to foreign markets, including the markets of the Asia-Pacific region.

The Company held negotiations with the key market players of Mongolia on the contract conditions for 2015-2016 and agreed on maintaining the pricing formulas and volumes at least at the level of 2014. In 2015, the Company supplied 777 kt of gasoline, diesel fuel, fuel oil and kerosene to Mongolia (increase by 24 % as compared to 2014), allowing the Company to increase its market share in Mongolia up to 80 %. All the contracts stipulate minimum monthly volumes acquired.

Petroleum products sales, mmt

| Region | 2014 | 2015 |

|---|---|---|

| Europe and other destinations | 43.6 | 46.3 |

| Wholesale in Russia | 20.3 | 18.8 |

| Retail in Russia | 11.2 | 10.9 |

| Asia | 11.7 | 13.2 |

| Bunkering | 4.0 | 3.0 |

| CIS countries | 2.3 | 2.0 |

| Total | 93.1 | 94.2 |

Domestic sales of petroleum products

In 2015, domestic sales of petroleum products amounted to 29.7 mmt (2014: 31.5 mmt).

Rosneft is the largest seller of motor fuels in the exchange market in Russia. In 2015, the Company was actively selling petroleum products in the exchange market while maintaining sales efficiency compared to alternative export channels. The share of the Company sales in the exchange increased in 2015 vs 2014: gasoline sales increased by 4 % and amounted to 30.1 %, diesel fuel - by 4 % amounting to 35.4 %. The Company exceeded the volumes of exchange-based trading approved by the joint decree of the Federal Antimonopoly Service of the Russian Federation and of the Ministry of Energy dated January 12, 2015. In 2015, the exchange-based trading volume of the Company was 18.2 % for gasolines vs. 10 % rate, 10.4 % for diesels vs. 5 % rate, 15.4 % for kerosene vs. 10 % rate and 3.1 % for fuel oil vs. 2 %.

In accordance with the Company Policy, the petroleum products supply to the federal partners is a priority. In 2015, Rosneft provided for all the needs of the military units of the Ministry of Defense in the Central and Eastern military districts as well as divisions of the Ministry of Internal Affairs, EMERCOM and the Federal Security Service. In 2015, the Company was designated as the sole supplier of motor fuels for over 50 structural divisions of the investigative authorities by the resolution of the Government of the Russian Federation as part of the program for expansion of cooperation with federal customers. The Company will continue to attract other federal customers in 2016.

Domestic sales of petroleum products, mmt

| Petroleum product | 2014 | 2015 |

|---|---|---|

| Diesel fuel | 9.3 | 9.6 |

| Gasoline | 11.4 | 11.7 |

| Fuel oil | 2.5 | 1.7 |

| Kerosene | 3.4 | 3.2 |

| Other | 4.9 | 3.5 |

| Total | 31.5 | 29.7 |

Petroleum products sales in the CIS countries

In 2015, Rosneft continued its stable tanker and ferry supplies to Armenia on; now it satisfies 60 % of the country’s demand. In addition, the Company signed a sales agreement for 100 % stake in LLC Petrol Market that owns a network of 22 petrol stations and 3 oil depots (including the tank farm of the bitumen plant of LLC ABIT). In 2015, the Company supplied 169 thousand tons of high-quality gasoline and diesel fuels produced by the Russian refineries of the Company.

In addition, Rosneft supplies gasoline and diesel fuels in the Kyrgyz Republic to the retail subsidiary Bishkek Oil Company for further sales via its own petrol stations and wholesale. In 2015, the Company supplied 54 kt of petroleum products. The supply increase allowed the Company to increase its presence in the petroleum products retail market of Kyrgyzstan – in Bishkek the market share is estimated at 30 %.

Despite the tough political and economic situation in Ukraine, the Company continued to supply petroleum products in the Ukrainian market. In 2015, the petroleum products supply to Ukraine amounted to 123 kt.

Rosneft continues to expand the international presence and diversify the supply routes. In 2015, the Company commenced supply to its own retail network in Georgia, and prepared to implement its new trading and logistics capabilities with starting the joint venture on the basis of Petrocas Energy Limited assets, a 49 % stake of which was purchased in the end of 2014. Thus, in 2015 Rosneft signed long-term diesel supply contracts with large european end-consumers: Mabanaft GmbH &Co. KG. and Motor Oil Hellas.

from production to fueling

Gas sales

THE COMPANY’S SHARE IN DOMESTIC GAS MARKET UPON RESULTS OF 2015

of traded gas volume at SPIMEX was provided by Rosneft

The Company supplies natural gas, dry and associated gas to consumers in Russia. Associated petroleum gas is supplied to the Company own gas processing plants (GPP) and to gas processing plants owned by SIBUR Holding. Natural gas and dry stripped gas are supplied to consumers via Gazprom unified gas distribution system under a gas transportation contract. Natural gas and dry stripped gas are supplied both to end consumers and to regional retail companies in nearly 40 regions.

IN ACCORDANCE WITH ITS LONG-TERM DEVELOPMENT STRATEGY, ROSNEFT INTENDS TO ESTABLISH ITSELF AS A LEADER IN THE DOMESTIC GAS MARKET OF RUSSIA AMONG INDEPENDENT GAS SUPPLYING COMPANIES.

The Company develops trading competences and searches for solutions to optimize supply in the domestic market in order to increase the revenue due to the inability to export gas through pipelines.

In view of the increased competition to attract consumers, the main strategic aim in monetizing gas resources of the Company is that to ensure guaranteed sales of growing gas output through long-term supply contracts with the largest financially reliable consumers. In 2015, the Company signed the following long-term contracts with its consumers:

- Long-term contract with JSC E.ON Russia with a total volume of gas amounting to 4.4 bcm, valid for five years;

- Long-term contract with EVRAZ Group to supply gas to its facilities with a total volume amounting to 14 bcm, valid for ten years.

At year-end 2015, the Company domestic gas sales amounted to 58.03 bcm, including 31.13 bcm in West Siberia and Ural Federal District, 2.69 bcm in the South of Russia, 0.78 bcm in the Far East, 23.43 bcm in European Russia and other regions.

In the Sverdlovsk Region, the Company covered nearly 87 % of the gas demand, ensuring supply to both industrial facilities and residents.

Sales growth in 2015 versus 2014 was driven by deliveries under the new contracts signed in 2014. The increase was accompanied by an increase in average sales prices by 8.1 % due to the gas price indexing in the domestic market. In June 2015, the Federal Tariff Service of Russia (FTS of Russia) (from July 21, 2015 the Federal Antimonopoly Service of Russia (FAS)) increased the wholesale gas price by 7.5 % and tariff for transporting for independent manufacturers through main pipelines by the national average of 2 % effective July 1 of the reporting year. The decision boosted gas sales performance of the Company even in the remote regions of supply. In 2015, Rosneft took active part in the natural gas auction at the St. Petersburg International Mercantile Exchange (SPIMEX), launched in October 2014, thus supporting the development of SPIMEX as a tool for efficient gas sales and ensuring the liquidity of auctions.

In 2015, the Company participated in gas trading at three delivery bases (balance points) of Nadym, Yuzhno-Balykskaya and Vyngapurovskaya compressor stations with the delivery anticipated in the following month. At year-end 2015, the Company share in the total trading volume of the natural gas contracted at exchange trading to consumers amounted to 35 % or 2.4 bcm.

The Company supported the day-ahead delivery, a new tool launched in October 2015 that facilitates optimization of irregular gas consumption for auction participants.

Retail sales

At year-end 2015, the retail geography of Rosneft comprised 59 regions in Russia, from Murmansk in the North, to the North Caucasus in the South, and from Smolensk in the West to Sakhalin in the East. The Company also owns retail assets in Abkhazia, Ukraine, Belarus, Kirgizia and Armenia.

As of December 31, 2015, the retail network of the Company included 2,557 own and leased filling stations, including 194 filling stations in Ukraine, Belarus, Abkhazia and Kirgizia. In total, own and leased sites had 1,819 shops, 691 cafes and 174 car washes. At 80 filling stations, there were small repair and car maintenance services.

As of December 31, 2015, the Company trade subsidiaries owned 135 operational oil depots, 2.6 mmcm in total capacity. The Company is continuously working to optimize and improve efficiency of its oil depot operations. In 2015, Rosneft shutdown 9 oil depots that failed to meet technical and operational requirements of the Company, and those with low turnaround and high unit costs. The other depots are in the process of automation and modernization. These measures were aimed at reducing the risks of petroleum products losses in quantity and quality and at improving industrial and ecological safety of these depots.

The Company owns about 1,000 gasoline trucks and takes measures to reduce operating costs for delivery by gasoline trucks, including logistics optimization.

The main directions of retail business development in 2015 was focused on efficiency increase by both income end expesne methods, including from one hand development of non-fuel business and small wholesales, and from the other — optimization of operating costs.

As part of the non-fuel business development the Company increased the number of filling stations with cafes. In order to provide customers with the service complying with the highest international service standards, the Company develops partnership projects with Italian companies Pirelli and Autogrill.

For convenience of the customers retail business site (www.rosneft-azs.ru) and wholesale business site (www.rosneft-opt.ru) were developed and put into operation, and Rosneft mobile app was launched.

In 2015, retail sales totaled 10.9 mmt of petroleum products, the average daily throughput per one filling station being 11.7 tons/day. Retail business of the Company demonstrates stable results compared to the overall decline in the petroleum products retail market in Russia, maintaining petroleum products sales per 1 filling station in Russia flat versus 2014.

The Company retail operations include gasoline, diesel fuel, consumer lubricants and liquefied gases.

Petrochemicals sales

In 2015, Rosneft sold 3.2 mmt of petrochemical products, a 3 % increase YOY. The volume included 2.2 mmt of petrochemical products sold overseas (including 2 mmt manufactured at Ruhr Oel GmbH refineries), and 1 mmt sold in Russia. In Q4 2015, the Company held annual tenders selling

1 mmt of petrochemical products which allowed the even distribution of the volumes and the establishment of long-term cooperation with customers.

In 2015, 80 % of petrochemical products were sold based on tenders and contracts with formula-based prices.

The year 2015 was marked with a significant event that influenced the development of the petrochemical business when Rosneft integrated with JSC Novokuibyshevsk Petrochemical Company, becoming the third largest producer of LPG in Russia.

B2B

Jet fuel sales

Rosneft is a leader in the Russian jet fuel market with a market share of around 32 %. The Company sells jet fuel through 20 fueling sites controlled by the Company and 19 partner fueling sites.

The Company increased jet fuel sales through signing supply contracts with the airline companies and covering new airports (Aeroflot, S7 Group, OJSC Ural airlines, Asiana, Korean Air, OJSC Polar airlines, I Fly LLC, OJSC Saratov airlines, Airline Severstal LLC). As a result, in 2015, the jet fuel sales to airlines increased by 1 % versus 2014 and amounted to 65 %.

As part of a project for entry into the international fuel oil market, the Company started its supplies to KazMunayGas-Aero LLP, a key player in the fuel oil supply market of Kazakhstan. The wholesale contract was signed with Magnai trade LLC for fuel oil supply to Mongolia. Rosneft also signed contracts with such large international suppliers as Shell, WFS and Air BP; the agreement of intent with AFS GmbH, one of the largest German operators, on fueling the Company customers in the largest airports in Germany. A contract was signed with a Vietnamese fuel company Petrolimeх.

However, due to decrease in the purchasing power and the subsequent reduction in number of flights in Russia, jet fuel sales in 2015 decreased by 5.9 % versus 2014.

Bunkering business

Rosneft activities in the bunkering business embrace all major sea and river bunkering ports in Russia, and several overseas destinations. In 2015, bunkering fuel sales amounted to 3 mmt, a 25 % decrease versus 2014 due to redistribution of fuel oil volumes to be exported; this redistribution relating to price environment change which is the result of the export duty decrease effective January 1, 2015.

In 2015, the Company implemented the following initiatives aimed at extending its presence at the bunkering market, including:

- as part of the production development the Company expanded the product range of bunkering fuel by starting to produce two types of distillate fuels at the Company’s refineries: DMF-I (at Angarsk Fuel and Petrochemical Refinery, Ryazan Refining Company, Komsomolsk Refinery) and DMF- III (at Angarsk Fuel and Petrochemical Refinery, Komsomolsk Refinery), as well as following types of residual fuel oil — RMG380 (Angarsk Fuel and Petrochemical Refinery, Komsomolsk Refinery), RMG500 (Angarsk Fuel and Petrochemical Refinery, Komsomolsk Refinery), RMG700 (Angarsk Fuel and Petrochemical Refinery) that fully conform to international bunkering fuel quality requirements;

- the Company carried out export deliveries of marine fuel for bunkering of fishing vessels in the fishing areas at the north of the Pacific Ocean;

- Bunkering fuel sales on the rivers of Volga-Don basin, Siberian Federal District and the Khabarovsk Territory increased to 477 kt or by 12 % versus 2014.

Bitumen product sales

In 2015, bitumen materials sales dropped by 13 % versus 2014 and amounted to 1.8 mmt due to bitumen production decrease following the growth of the fuel oil production for export.

Domestic market sales amounted to 97 % of the total sales in the reporting period.

In 2015, in addition to the existing export destinations (Mongolia, Armenia, Ukraine, and Belarus) the Company started export to the Baltic States and Kirgizia.

Lubricant sales

In 2015, the total lube sales of the Company increased by 6 % versus 2014 and amounted to 779 kt, with 457 kt (59 % of the total output) of the product were sold in Russia.

In 2015, premium lube sales increased by 14 % (2014: 48 kt) and amounted to 55 kt.

In 2015, a number of initiatives were implemented to extend the Company’s presence in the lubes market in Russia, including:

- Representative offices in Kazakhstan, China and Turkey were opened for purposes of extending geography of sales;

- agreements were reached and work is underway to substitute imported oils by the Company oils at over 80 large enterprises of the Russian Federation;

- 7 strategic partnership agreements for petroleum products supply were signed with the largest Russian companies;

- lube sales development program was launched to sell the Company lubricants at official AVTOVAZ service stations;

- the Company started a large-scale advertising campaign to promote the motor oils of the Company in Russia, Belarus and Kazakhstan, including TV, radio, Internet, outdoor advertising and advertising in the press;

- The Company extended its product range and launched new products: Rosneft Plastex (a line of premium lubricants); Gidrotec ZF HVLP (ashless multigrade hydraulic oils); Gidrotec OE HLP and Gidrotec OE HVLP (hydraulic oils for equipment with high degree of wear resistance); and a special insulating oil MEI-20.

PRODUCTION PLANNING AND LOGISTICS

Key performance results in 2015:

- The Company fulfilled the shipment plan for crude and petroleum products.

- The Company optimized the production program for refineries and petroleum product sales directions within monthly production plans and petroleum products redirecting schedules.

- The cost of rail tanker leasing was reduced; train costs were reduced by organizing direct railway routes and controlling rail tanker loading level with the help of thermal control.

- The Company organized new efficient logistic channels for crude and petroleum products sales and optimized the existing channels: shipments of crude oil by rail to China through Mongolia from Meget shipment point, transshipment of VGO in Tuapse and Vanino, transshipment of fuel oil in the port of Slavyanka, multimodal scheme for VGO export shipments through the terminal in Nizhnekamsk, reducing the cost of transshipment in the port of Taman and the ports of Estonia.

- Despite the bad hydrological conditions, the Company fulfilled the plan for river transportation. The Company organized a river transportation scheme with tows and tugs, transshipment and loading in the harbors of Volgograd and the lower Don River.

- The Company hit a record high in transshipment via terminal in Tuapse (16.3 mmt).

- The Company completed acquisition of the shipping assets of Prime Shipping LLC. This logistics asset with a modern and safe fleet will allow the Company to strengthen its position in the river transport market and increase efficiency of its operating activities.

- The Company increased short-distance and middle-distance shipments of motor fuels by road (instead of railway) from the refineries directly to the filling stations (without depots) which has resulted in transportation costs reduction.

Logistics infrastructure objects of the Company

petroleum products transshipment volume through the company’s terminals

transhippment volume through new deep-water Tuapse dock

Transshipment terminal of OJSC RN-Nakhodkanefteprodukt

The terminal is mostly used for the export of petroleum products from the Komsomolsk Refinery, Angarsk Fuel and Petrochemical Company, and the Achinsk Refinery. It is also used for transshipment of petroleum products to the domestic market, namely, to the Magadan and Kamchatka Regions and to Sakhalin. The transshipment capacity is up to 7.5 mmt of petroleum products per year. The terminal is implementing a program of production assets renovation, in order to bring them into compliance with the new requirements of industrial, ecological and fire safety. In 2015, the terminal continued to acquire investments for renovation of the tank farm, process piping and utility networks. In 2015, the volume of petroleum products transshipment through Nakhodka terminal (including bunkering for export and domestic market) amounted to 6.8 mmt.

Transshipment terminal of Arkhangelsknefteprodukt LLC

The terminal is used for transshipment of petroleum products of the Company and third parties for export, as well as for bunker fuel transshipment services. In 2015, transshipment of petroleum products (including bunkering) through the terminal totaled to 1.9 mmt. Since 2014, the Terminal continues a program of production assets reconstruction, in order to bring them into compliance with the new requirements of industrial, ecological and fire safety.

Transshipment terminal of Tuapsenefteprodukt LLC

The capacity of the terminal located near the Tuapse Refinery is 17 mmt per year. The terminal is mostly used for export of petroleum products from Tuapse, Achinsk and Samara Refineries.

The terminal is implementing a program of production assets reconstruction, in order to bring them into compliance with the new requirements of industrial, ecological and fire safety, and joint development of production capacity with the Tuapse Refinery to ensure long-term turnover. In 2015, the terminal finished technical re-equipment of the loading section and continued reconstruction of technological equipment at the oil berths of the trading port and of utility networks; as well as construction of sewage treatment plants.

In 2015, transshipment of petroleum products (including bunkering for export and domestic market) through the terminal totaled to 13.8 mmt, and together with the transshipment of petroleum products from third parties —

16.3 mmt; 8.6 mmt of petroleum products were handled including those through the new deep-water dock.

oil products transshipment in the Far East