Rosneft is a public joint stock company with securities traded on Russian and overseas stock markets. Public trading binds the Company to meet the highest corporate governance standards.

Rosneft corporate governance is a system of relations between the executive bodies, the Board of Directors, its share and stakeholders that aims to:

- exercise of shareholders and investors rights;

- increase of Company’s investment potential;

- create viable mechanisms of risk assessment capable of influencing the Company value;

- ensure efficient use and safety of the funds contributed by the shareholders (investors).

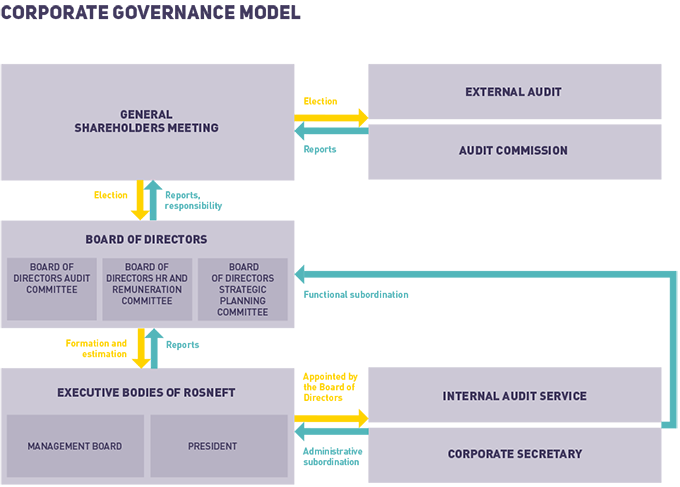

The current corporate governance model of Rosneft provides separate functions of strategic leadership, control and operating management of the Company.

The GENERAL SHAREHOLDERS MEETING is the supreme governing body of the Company responsible for the following key issues:

- approval of the Charter and regulations on the management and control bodies, introduction of changes and amendments;

- election of the Board of Directors, the Audit Commission and the Auditor;

- approval of the annual reports and the annual accounting (financial) statements;

- distribution of profit and loss based on the results of the fiscal year, payment (declaration) of dividends;

- increase or reduction of the charter capital;

- reorganization or liquidation of the Company;

- split or consolidation of the shares.

Board of Directors acts on behalf and in the interests of all the shareholders and the Company, is accountable to the General Meeting of Shareholders, and is responsible for strategic management and control of performance of the executive bodies of the Company. The Board of Directors is competent for the following:

- to determine the priority directions of the Company’s activity,

- to implement the strategic business projects and to execute transactions;

- to elect the executive bodies of the Company, to determine their key performance indicators and to estimate their activities;

- to determine the Company’s policy on internal control, risk management and audit; in remuneration to the management of the Company; in managing conflicts of interest; in innovations; in dividend, information, HR and social policies of the Company;

- to determine the Company’s policy on strategic issues for the companies of Rosneft Group.

Committees within Board of Directors

Audit Committee is responsible for oversight of completeness, accuracy and reliability of the Company’s accounts; of reliability and efficiency of the internal control and risk management system; of assurance of independence and objectiveness of the internal and external audit functions.

HR and Remuneration Committee, which functions include assessing effectiveness of the HR policy and remuneration system, setting criteria for candidate selection to the Company’s Board of Directors and Management board; assessing performance of the Board of Directors, of the executive bodies and of top managers of the Company.

Strategic Planning Committee assisting the Board of Directors in defining the Company’s strategic goals and assessing its performance in the long term.

Executive bodies, being accountable to the General Meeting of Shareholders and to the Board of Directors, ensure implementation of resolutions taken by the General Meeting of Shareholders and by the Board of Directors of Rosneft; provide effective management of the Company’s operations and determine the Company's position on significant issues of the Rosneft Group companies. The JSC Rosneft Oil Company’s executive bodies system consists of the Management Board — a collective executive body and the President — a sole executive body of the Company which govern the Company’s current activities and which are accountable to the General Meeting of Shareholders and to the Company’s Board of Directors.

External Audit is a commercial organization which is a part of one of self-regulating audit organizations with a right to examine economic subjects of social importance and which meets purchase documentation requirements.

Audit Commission controls the financial and economic activities of the Company, identifies and assesses the risks arising as a result or in the course of its business and financial operations, including:

- audit of the Company operations based on the annual performance of the Company;

- audit of the Company operations at any time on the initiative of the Audit Commission, under a resolution of the General Meeting of Shareholders or of the Board of Directors, or upon request of the shareholder(s) holding at least 10 percent of the shares;

- assessment of reliability and accuracy of the data in annual reports and other financial documents of the Company

Internal Audit Service assists the Board of Directors in raising the Company’s management efficiency, improving its financial and economic activities including systematic and gradual assessment of the internal control and risk management system and of the corporate governance system representing the rational assurance in the Company’s goals and helps to provide:

- the reliability and integrity of the provided information concerning the Company’s financial and economic activities including the Group companies.

- efficiency and productivity of the activities of the Company and the Group companies.

- research of internal resources to raise finantial and economic activities of the Company and of the Group companies.

- the safety of the property of the Company and of the Group companies.

Corporate Secretary provides efficient execution of the Corporate Policy and organization of efficient communications between the Company and its shareholders, the governing and control bodies, in particular to:

- implement the procedures to protect the shareholders’ rights;

- ensure efficient work of the Board of Directors and its committees;

- arrange for information disclosure and protection of insider information;

- provide for interactions with the securities’ regulator, registrar and professional traders;

- improve the corporate governance system.

The Charter of Rosneft and the internal documents of the Company provide guidelines for all the members of the corporate management system. .

One of the key documents to regulate the corporate governance of the Company is the Corporate Governance Code of Rosneft approved by the Board of Directors on June 11, 2015 (hereinafter the Code)1.

The Code states and describes the principles which form the base of the corporate governance system of Rosneft and which meet the world’s best practices.

1. The Code includes the following rules in relation to observance and protection of the shareholders rights:

- information and materials for the General Meeting shall be available in the Russian and English languages at least 30 days prior to the date of the meeting;

- the materials for the General Meeting shall contain information on the person who proposed a particular item to be included to the agenda of the General Meeting or has nominated any candidates to be elected to the management bodies;

- directions on how to get to the venue of the General Meeting of Shareholders and a sample form of a proxy for the shareholders’ representatives shall be posted at the official website of the Company;

- the Board of Directors of the Company shall approve the dividend policy containing transparent rules for the calculation and payment of dividends;

2. The Code includes the following newly accepted norms targeted at having the professional and effective Board of Directors:

- the Board of Directors shall have the self-assessment executed each year and the standard assessment to be made by an independent expert at least once in three years;

- the Board of Directors shall decide on its additional competences to be acquired; this issue shall be discussed at in-person meetings of the Board (except for ordinary meetings provided for in the Charter of Rosneft);

3. In information disclosure the Code stipulates the Company obligations to disclose not only the information provided for in the current legislation, but the information recommended for disclosure by the best corporate governance standards (including the Corporate Governance Code of the Bank of Russia).

Compliance to the highest corporate governance standards and maximum information transparency are the key factors to increase investment attractiveness and economic efficiency of Rosneft that gives a boost to the investors’ and counterparties’ confidence, reduces the risk of inefficient use of resources by the Company, increases the Company value and adds to prosperity of its shareholders.

The Company may ascertain the compliance of its corporate governance system with the listing rules of the Moscow and London stock exchanges, with the main corporate governance principles recognized by the global economic community (e.g., corporate governance principles of the Organisation for Economic Co-operation and Development, European Shareholders, corporate practice norms of the European Bank for Reconstruction and Development), as well as to the key recommendations of the Bank of Russia.

The corporate governance is a complex multi-level system of relations, constantly developing under the influence of both internal factors and the external environment. As for the internal factors, the Company to apply high corporate governance standards is targeted at increase of investment attractiveness and trust of partners. The external factors, such as changes in macroeconomics, give the challenges, the solution of which affects further development of the Company.

In this regard, the Company should constantly monitor external and internal changes, and trends analysis in the global and national processes that may affect the corporate governance standards.

The key trends of the Russian corporate governance are stated in the Corporate Governance Code approved by the Board of Directors of the Bank of Russia on March 21, 2014 and recommended for application by the Russian joint-stock companies with securities admitted to trading

On February 27, 2015, the Board of Directors approved the action plan (Roadmap) for implementation of the recommendations of the Corporate Governance Code of the Bank of Russia that were left uncovered, though they were among the key tasks of the Company in 2015.

IN 2015, IN ADDITION TO THE REVISED CORPORATE GOVERNANCE CODE, THE BOARD OF DIRECTORS APPROVED AND REVISED A NUMBER OF INTERNAL DOCUMENTS WITHIN THE FRAMEWORK OF THE ROADMAP IMPLEMENTATION, INCLUDING:

1. On June 11, 2015, the Board of Directors approved a new edition of the Regulations on the Corporate Secretary of Rosneft that defines the functions, powers, rights and duties of the Corporate Secretary, performance appraisal and remuneration for the Corporate Secretary, as well as requirements for disclosure of information on the Corporate Secretary, that comply with recommendations of the Corporate Governance Code.

2. On May 22, 2015, the Board of Directors approved amendments to the Regulations on HR and Remuneration Committee2 of the Board of Directors of Rosneft that are targeted at implementing the recommendations of the Corporate Governance Code by the Bank of Russia.

The new edition of the Regulations stipulates the following key functions of the HR and Remuneration Committee:

- to define a methodology for self-assessment and develop proposals to select an independent consultant to assess the work of the Board of Directors of the Company;

- to hold an annual detailed assessment (self-assessment/external assessment) of the performance of the Board of Directors, its committees, and the members of the Board of Directors;

- to consider the assessment results and proposals of the Board of Directors regarding improvement of activities and procedures of the Board of Directors, to determine priority areas to improve the Board of Directors;

- to consider conformity of candidates to the members of the Board of Directors, to analyze compliance of the independent Directors (taking into account the information they provided) to independence criteria, to prepare and submit to the Board of Directors the conclusion on the independence of candidates (members of the Board of Directors), including information about the circumstances in which a member of the Board of Directors ceases to be independent;

- to consider whether it’s rational to implement long-term incentive plans taking into account the business model of the Company, its planning horizons, objectiveness of long-term indicators, the expected motivational effectiveness and cost of implementing such a program (the Committee will discuss this issue in 2016).

3. In 2015, the Board of Directors approved the following internal documents:

- Policy on Internal Audit that stipulates among others that the internal audit division shall be subordinate to the Board of Directors;

- Policy on the Internal Control and Risk Management setting out goals, objectives and key principles of the Company’s risk management and internal control systems as well as alignment of its agents responsibilities;

- Regulations on Remuneration to the members of the Board of Directors, stipulating in accordance to the Corporate Governance Code of the Bank of Russia that members of the Board of Directors shall be entitled to seek professional advice at the expense of the Company on issues related to the competence of the Board;

- Regulations on Remuneration and Compensations to the Audit Commission members, prepared in conformity with the Methodical recommendations by Rosimushchestvo (Russian Agency for State Property Management);

- Regulations on the induction of the members of the Board of Directors, stipulating the procedures to inform the members of the Board of Directors on the performance of the Company with the purpose of a quick, complete and effective immersion in the specifics of the Company;

- Regulation on Remuneration and Compensations to top managers, stipulating dependence of remuneration of the Company top managers on their achieving the key performance indicators developed in accordance with the long-term strategy of the Company and approved by Board of Directors.

Members of the Board of Directors assessed:

According to the plans for 2015 stated in the Roadmap, the Board of Directors held the self-assessment in May 2015 (for 2014-2015 membership) based on the questionnaire approved by the HR and Remuneration Committee.

- members and structure of the Board of Directors;

- key processes and functions of the Board of Directors;

- working procedures of the Board of Directors.

The results of the self-assessment were presented to the HR and Remuneration Committee and to the Board of Directors in June 2015. The following measures were taken with regard to the self-assessment results:

- in accordance with the stated Regulations on the induction of the members of the Board of Directors the newly elected members are familiarized with:

- the Charter and the key internal documents of Rosneft regulating the Company operation and control;

- strategic documents and plans of the Company financial and economic performance;

- the organizational structure of the Company.

- working meetings were held with the assistants and experts authorized by the Board members to cooperate with the Company to provide help to the Board members in their activity; the following issues were discussed:

- cooperation in preparation and holding the Board of Directors meetings;

- documentation procedure of the Company;

- procedure of working with confidential information;

- preparation of the Company reports and information on the Board of Directors members to be included in such reports;

- practice of corporate governance of the Company.

- The Company started to work with the certified information system Portal SD that helps the Corporate Secretary to place the materials for meetings in a secured information space and the Board members to see these materials, even with remote access;

- The work plans of the Board of Directors and its committees for the next corporate year include the following issues to be discussed and considered thoroughly: control of the executive bodies’ performance, organization of the risk management and internal control system, assessment of risk management effectiveness, results of audits conducted by the internal audit service, assessing the level of corporate governance in the Company;

- The Board of Directors discussed the following key issues at their in-person meetings: financial and economic performance plans, the Company strategy, the long-term development program);

- If during a meeting any Board member has any questions, the Board gives a prompt response providing all the necessary additional information and the supporting documents;

- Regular business meetings were organized to discuss the Audit Committee competence as well as preliminary meetings on the items to be considered at the Board meetings.

In 2015, based on the self-assessment procedure for the corporate governance quality in the companies with state participation approved by the Order No. 306 of Rosimushchestvo (Russian Agency for State Property Management) dated August 22, 2014, and methodical recommendations for internal audit in joint-stock companies with state participation approved by the Order No. 249 of Rosimushchestvo dated July 4, 2014, the Company held an internal audit of the corporate governance system. According to the results, Rosneft complies with 88 percent of the recommendations stipulated in the Corporate Governance Code approved by the Bank of Russia that is significantly higher than the minimum (65 percent) recommended by Rosimushchestvo.

In 2016, the Roadmap will be furtherly implemented, including changes to the Charter and the regulations on the management bodies of Rosneft in order to formally fix the principles that are already implemented by the Company.