trip to the Company refineries

in the Samara region

COOPERATION WITH INSTITUTIONAL INVESTORS

Rosneft shares are one of the most attractive investment targets among the Russian issuers.

10.75 % of them are free-floating, including 7.50 % in the form of global depositary receipts (GDRs) listed on the London Stock Exchange (LSE). The company has a diversified investor base of more than 700 institutional investors.

International institutional investors of the Company are headquatered in the major centers of business and financial activity, including New York, Boston, Los Angeles, London, Frankfurt, Stockholm, Hong Kong, Singapore and Tokyo.

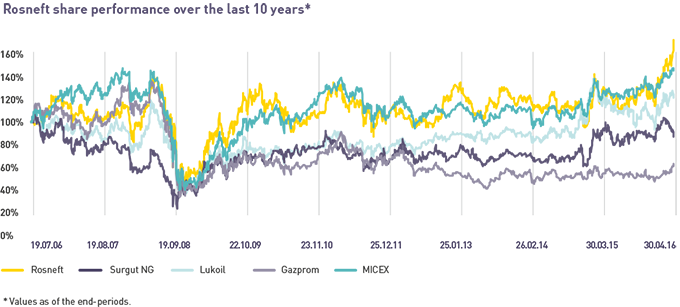

For ten years since the IPO, Rosneft quotes have shown an upward trend, exceeding peers and MICEX Index figures. Thus, for the period starting July 19, 2016 and by the end of April, 2016 Rosneft stocks increased 72% on MICEX which is 51-110 pp higher than the nearest competitors’ and 25 pp above the MICEX index numbers.

SPEAKING OF MAJOR COMPANIES, WE PAY ATTENTION TO THEIR FOCUS ON SELF-FINANCING AND POSITIVE CATALYZERS OF CAPITALIZATION GROWTH. THE PRIORITY IS GIVEN TO THE ROSNEFT SHARES (TO BUY RECOMMENDATION). WE FORECAST THAT IN 2016 THE ROSNEFT SHARES SHALL BE TRADED THE BEST AMONG THE OTHER OIL COMPANIES, AS ROSNEFT MANAGED TO PREVENT THE BALANCE MISALIGNMENT AND IS SHOWING HIGH RATE OF PRODUCTION AND OPEX REDUCTION >>.

Morgan Stanley analyst

Rosneft key index membership

| Index | Company weight |

|---|---|

| MSCI Russia | 3.61 % |

| FTSE Russia IOB | 11 % |

| MICEX | 4.21 % |

| SCI1 | 21.367 % |

Major international institutional investors of Rosneft

| Institution | Country |

|---|---|

| Alfred Berg Kapitalförvaltning AB | Sweden |

| Amundi Asset Management SA | France |

| APG Asset Management | Netherlands |

| BlackRock, Inc. | USA |

| Canada Pension Plan Investment | Canada |

| Capital International, Inc. | USA |

| Credit Suisse AG | Switzerland |

| Deka Investment GmbH | Germany |

| Delaware Management Business Trust | USA |

| Deutsche Asset&Wealth Management | Germany |

| Dimensional Fund Advisors LP | USA |

| Goldman Sachs Asset Management LP | USA |

| Grantham, Mayo, Von Otterloo Co. | USA |

| HSBC Global Asset Management | UK |

| Invesco PowerShares Capital Management | USA |

| JPMorgan Asset Management | UK |

| Neptune Investment Management Ltd. | UK |

| Nordea Investment Management AB | Denmark |

| Norges Bank Investment Management | Norway |

| Parametric Portfolio Associates LLC | USA |

| Pictet Asset Management | Switzerland / UK |

| Raiffeisen Kapitalanlage-Gesellschaft mbH | Austria |

| RAM Active Investments SA | Switzerland |

| Robeco Institutional Asset Management BV | Netherlands |

| SEB Varahaldus AS | Estonia |

| Sjunde AP-fonder | Sweden |

| SSgA Funds Management LLC | USA |

| Swedbank Robut Fonder AB | Sweden |

| The Casse de depot et placement du Québec | Canada |

| The Dreyfus Corp. | USA |

| The Vanguard Group | USA |

| TIAA-CREF Investment Management | USA |

| UBS AG Investment Management | Switzerland |

| UBS Asset Management Ltd. | UK |

| Wellington Management Group | USA |

Source: FactSet.

THE COMPANY TSR IN 2015, WHICH IS BY 8 p.p. HIGHER THAN AN AVERAGE INDICATOR OF THE COMPARABLE RUSSIAN COMPANIES

IN 2015 THE TOTAL SHAREHOLDER RETURN IS BY 4.2 p.p. HIGHER THAN THE GROWTH OF MICEX INDEX OF COMPANIES WITH STATE PARTICIPATION

In 2015, the total shareholder return (TSR) of Rosneft was 35.3%, which is 8 pp higher than the average for the Russian peer group.

Cooperation with current and potential investors of the Company is carried out by the Chairman of the Management Board, senior management of the Business units, Vice-President for Economics and Finance, as well as Investor Relations Department. In 2015, an active investor relations program was carried out, including 9 strategic presentations by the Chairman of the Management Board at major international investment forums, as well as about 150 one-on-one and group meetings held by the Company management with leading investment funds. The feedback received from investors is reported to the Company management on a regular basis.

Currently, the Company is covered by 18 investment banks. Thanks to successfull efforts during 2015 five investment banks upgraded their recommendations including 3 who switched from “Hold” to “Buy”.

Key trading figures of Rosneft ordinary shares and depositary receipts in 2015

| Instrument | 52 week high | 52 week low | Volume-weighted average price | Average daily trading volume, mln | Average daily trading value, USD mln |

|---|---|---|---|---|---|

| Depositary receipt (LSE), USD | 5,24 | 3,19 | 4,07 | 6,39 | 25,96 |

| Ordinary shares (MICEX), RUB | 290,20 | 196,75 | 247,40 | 4,79 | 19,47 |

Source: Bloomberg

| Bank | Recommendation, begining of 2015 | Recommendation, end of 2015 | ||

|---|---|---|---|---|

| 1. | Gazprombank | Hold | Hold | |

| 2. | Otkrytie | revised | Hold | |

| 3. | Renaissance Capital | Hold | Hold | |

| 4. | Sberbank CIB | Hold | Hold | |

| 5. | Uralsib | Hold | Hold | |

| 6. | BCS prime | Sell | Hold |  |

| 7. | Bank of America Merrill Lynch | Hold | Hold | |

| 8. | Citibank | Hold | Buy |  |

| 9. | Credit Suisse | Hold | Sell 1 |  |

| 10. | Deutsche Bank | Hold | Buy |  |

| 11. | Goldman Sachs | Hold | Buy |  |

| 12. | HSBC | Sell | Sell1 | |

| 13. | J. P. Morgan | Sell | Hold |  |

| 14. | Morgan Stanley | Buy | Buy | |

| 15. | Raiffeisen Bank | Buy | Buy | |

| 16. | UBS | Hold | Hold2 | |

| 17. | Aton | on watch | on watch | |

| 18. | ВТБ | on watch | on watch |

Key IR events IN 2015

February

Speech of the Chairman of the Management Board at the International Petroleum Week (IP Week) conference in London.

Speech of the Chairman of the Management Board at the International Petroleum Week (IP Week) conference in London.

Meeting of the Company management with leading international funds.

March

Disclosure of the Company’s Q4 and 12M 2014 results. Conference call for investors with the participation of the Finance and Business units management.

Video call of the Head of Finance unit with members of the UBS investment conference in the USA.

Group meeting of the Company top managers with investors.

April

One-on-one meetings with investors during the Sberbank CIB investment conference.

One-on-one meetings with investors during the Sberbank CIB investment conference.

May

Meeting of the Chairman of the Management Board and heads of Business units with the representatives of international investment funds as to the strategic priorities of Rosneft and the basic parameters of the business plan.

Publication of the Rosneft Annual Report.

June

Shareholder Identification and Perception Study implementation.

Speech of the Chairman of the Management Board at the Annual General Shareholders Meeting.

Speech of the Chairman of the Management Board at the St. Petersburg International Economic Forum.

Disclosure of the Company’s Q1 2015 results.

Conference call for investors with the participation of the Finance and Business units management.

Meeting of the Finance and Business units management with analysts of the leading investment banks in the framework of the Annual General Shareholders Meeting.

July

Group meeting of the Company top managers with investors.

August

Disclosure of the Company’s Q2 2015 results.

Disclosure of the Company’s Q2 2015 results.

Conference call for investors with the participation of the Finance and Business units management.

September

Speech of the Chairman of the Management Board at the Eastern Economic Forum in Vladivostok.

October

Speech of the Chairman of the Management Board at the IV Eurasian Forum in Verona.

One-on-one meetings with investors during the VTB Capital Investment Forum RUSSIA CALLING!

One-on-one meetings with investors during the investment conference of J.P. Morgan ‘Credit&Equities Emerging Markets Conference’ in London.

Site-visit of the analysts of the leading investment banks to the Company’s fields and refineries in the Samara Region.

November

Rosneft participation at the conference ‘Power bridge Russia – Japan’ in Tokyo.

Individual meetings with investors under CEEMEA 1 on 1 Conference hosted by Goldman Sachs.

Individual meetings with investors under Global Natural Resources Conference investment conference of Goldman Sachs.

Disclosure of the Company’s Q3 2015 results.

Conference call for investors with the participation of the Finance and Business units management.

December

One-on-one meetings with investors during Moscow Exchange and UBS Forum in London.

One-on-one meetings with investors during Moscow Exchange and UBS Forum in London.

One-on-one meetings with investors during UBS Global Emerging Markets One-on- One Conference.

Shareholder Identification and Perception Study implementation.

One-on-one meetings with investors in USA.

THE ROSNEFT ANNUAL REPORT FOR 2014 WAS PRIZE-WINNER IN THE CATEGORY OF ‘BEST ANNUAL REPORT OF THE COMPANY WITH A CAPITALIZATION OF OVER RUB 200 bln’ AT THE XVIII ANNUAL CONTEST OF ANNUAL REPORTS ORGANIZED BY THE MOSCOW EXCHANGE AND THE RCB MEDIA GROUP.

Chairman of the Management Board as well as Heads of Business units support the regular cooperation with the investment community. These meetings allow the investors, analysts, representatives of international rating agencies to receive first hand information about the vector of the Company’s strategic development, production activities and financial management. On a quarterly basis, Rosneft holds conference calls for investors with the participation of the Finance and Business units management covering results for the reporting period in detail. Information for shareholders and investors, including press releases, presentations, Rosneft Annual and Sustainability Report, material facts on decisions of the Board of Directors and the Management Board are published on the corporate website www.rosneft.ru